Topic What: How big is the dating app business

| PLANET OF THE APPS DATING APP | Asian gay boy dating |

| LOCAL DATING EVENTS IN AUSTIN | Fat jewish girls dating service |

| FREE ONLINE DATING SITES FOR SINGLES HOKING UP | Asian guys disadvantage in dating world |

| RUSSIAN DATING APPS REDDIT | Are there any real dating apps? |

Dating App Market [Sector Profile]

In 2013, Tinder revolutionised the online dating industry with a simple system, swipe right if interested, left if not. Instead of having a matchmaker rifle through thousands of profiles to find someone unique, users could decide whether they liked someone based off a few photos.

In comparison to the services which had come before, Tinder made dating simple, but it also, as studies have found, made it less about lasting connections and relationships and more about casual hook-ups and cheesy openers.

What’s rather unique about Tinder, in the age of entrepreneurs and startups, is that it was built by Hatch Labs, a startup incubator funded by IAC, a holding company responsible for Match.com, Plenty of Fish and OK Cupid.

Instead of an outsider crushing the competition, IAC built its own cannibal, which has eaten away at the market share held by Match.com and its affiliate sites.

In the United States, Tinder has ruled the roost since its inception, but in Europe and South America, Badoo has been the frontrunner. Created by Russian entrepreneur Andrey Andreev, Badoo has had many lives, including as a social games and quiz app in Facebook Games heyday in the early 2010s.

Badoo is the most downloaded dating app in the world, with over 400 million registered users, but it has not been able to make a mark in the US. In 2014, Andreev partnered with Tinder co-founder Whitney Wolfe Herd, who left the company after tensions with executives, to found Bumble.

Where Badoo failed, Bumble succeeded in drawing North American users away from Tinder. Marketed as the feminist dating app, Bumble allows women to make the first move, giving them full control of the experience.

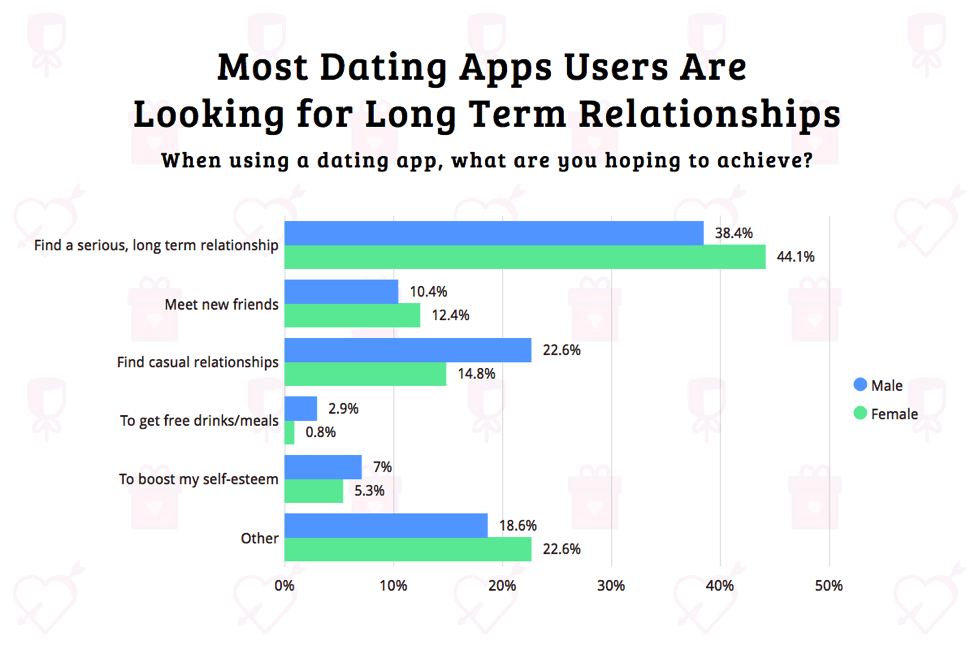

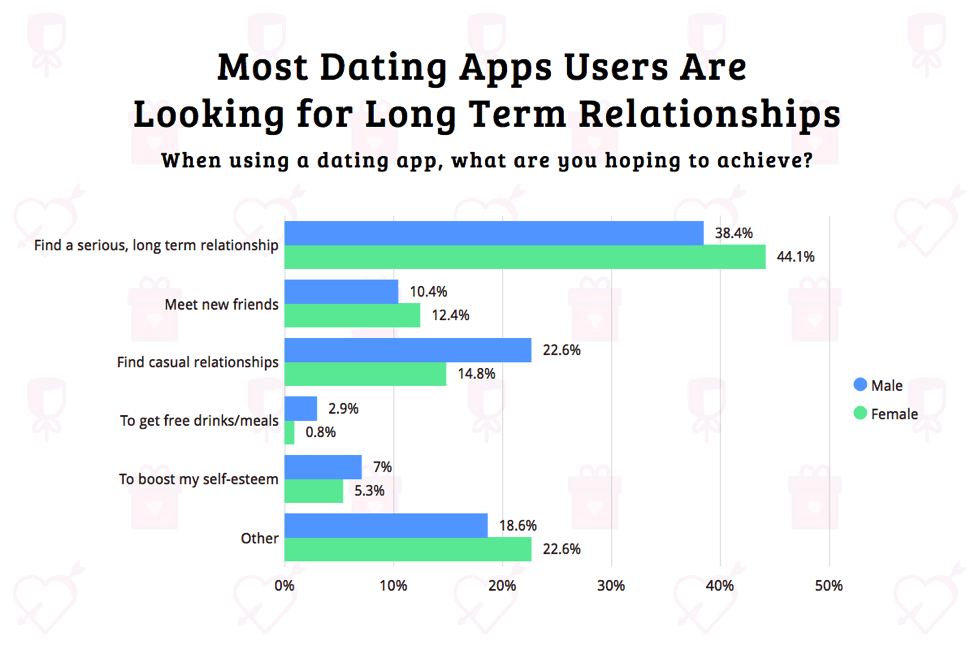

Bumble’s growth in the past few years has also marked a change in attitudes towards dating, as people have started to turn away from the casual hook-up culture of Tinder. Hinge, another IAC-owned app, switched its entire platform in 2017 to focus on long term relationships.

That said, the culture is not devolving back to the Match.com era. Tinder and Badoo are still the leaders in monthly active users, and in emerging markets like China and South-east Asia, casual dating apps are far exceeding long-term services in popularity.

Table of Contents

Top Dating Apps

Global Dating App Statistics

Global Dating App Market Share

Global Dating App Valuations

Global Dating App Projected Revenue

Top Dating Apps

| Tinder | The crowning jewel of Match Group, which owns over 45 dating apps. Tinder fundamentally changed online dating by removing the seriousness and giving users more control |

| Bumble | Tinder’s main rival in North America, designed to give women control of the experience. Bumble was started by Tinder co-founder Whitney Wolfe Herd, who left after tensions at the company |

| Badoo | Badoo started far before Tinder and Bumble as a social search, games and quiz app. After receiving a warning from Facebook in 2013, it transitioned to casual dating in the same form as Tinder |

| Hinge | Hinge may have been destined to be one of the many dating app failures, but the team reformed the app for long-term relationships and has hit the ground running in North America |

| Happn | Unlike the other apps on the list, which use location in a general sense to find matches, Happn is critically focused on matching users with people they may have seen recently |

| Grindr | While Tinder, Bumble and most other dating apps have settings for gay users, Grindr was the first app to be specifically for LGBTQ people and remains the most popular app for gay people |

| Tantan | Casual dating is not as popular in China as it is in the West, however, Tantan, known as China’s Tinder, has accumulated a sizeable community of singles, primarily college students |

| Plenty of Fish | One of the old guard, Plenty of Fish has been around since 2003. It has transitioned well into the mobile age, as one of the more popular apps used by older people |

Global Dating App Revenue

| Year | Revenue |

| 2015 | $1.69 billion |

| 2016 | $1.88 billion |

| 2017 | $2.05 billion |

| 2018 | $2.23 billion |

| 2019 | $2.52 billion |

| 2020 | $3.08 billion |

Revenue in the dating app market has increased at a steady rate, powered primarily by Tinder and Bumble, which have captured the most profitable region, North America.

All dating apps covered in this sector profile use a freemium model which removes limitations, such as the amount of swipes, alongside providing ways to skip the matchmaking algorithm. However, the barrier to entry is much lower than on older dating sites, so the vast majority of users do not pay for premium services.

Global Dating App Users

| Year | Users |

| 2015 | 185 million |

| 2016 | 200 million |

| 2017 | 220 million |

| 2018 | 235 million |

| 2019 | 250 million |

| 2020 | 270 million |

Increases in usage have been primarily pushed by newer applications, such as Tinder, Bumble and Hinge, which are mobile based and far more tailored to casual dating. In the past few years, Bumble and Hinge have attempted to shift from Tinder, by marketing their product as more for relationships than hook-ups.

While casual dating is not as prevalent in Asia, there are a few apps that have recorded double digit monthly active users. Tantan, operated by Chinese social search provider Mono, is one of the most popular, with an estimated 20 million monthly active users.

Global Dating App Market Share

Sources: Airnow, DSR, Mixpanel

Badoo and Tinder are the two largest platforms worldwide, although Tinder seems to still be growing while Badoo has lost active users in the past five years. Bumble is the challenger to Tinder’s supremacy in the North American and European market.

Interests have changed somewhat in the past five years, as users look for apps that deal in long-term relationships instead of casual hook-ups. While older services, such as Match.com and Plenty of Fish, provide these more serious services, Bumble and Hinge have attempted to retrofit their applications to service both markets.

Note: Values are based on monthly active users.

US Dating App Market Share

Sources: Statista, Verto

In comparison to global results, Badoo is almost non-existent in the US market. The size of Tinder and Bumble, in comparison to legacy dating sites like Match.com and Plenty of Fish, illustrates how online dating has shifted to a more casual, mobile-orientated experience.

IAC, the owners of Match Group, control every service on this list apart from Bumble and Grindr.

Note: Values are based on monthly active users.

Global Dating App Valuations

| App | Valuation |

| Tinder | $10 billion |

| Bumble | $4 billion |

| Tantan | $3 billion |

| Badoo | $3 billion |

| Hinge | $2 billion |

| Grindr | $0.6 billion |

As the most popular app in the highest revenue-per-user region (North America), Tinder has been independently valued higher than Badoo, which has similar monthly active user figures. Badoo’s main audience is in Europe and South America, which on average are less likely to spend money on dating apps.

MagicLab, the developer behind Bumble and Badoo, recently changed its corporate name to Bumble. The combined company is expected to IPO on a $6 to $8 billion valuation. We believe Bumble is the more valuable of the two assets, due to its recent growth in the US market. Ex-CEO of MagicLab, Andrey Andreev, recently sold the company to investment firm Blackstone for $3 billion, far less than the estimated value of Bumble.

Hinge’s high valuation comes from its demographics, which are primarily North American college students.

Global Dating App Projected Revenue

| Year | Revenue |

| 2020 | $3.08 billion |

| 2021 | $3.33 billion |

| 2022 | $3.72 billion |

| 2023 | $4.36 billion |

| 2024 | $5.05 billion |

| 2025 | $5.71 billion |

The dating app sector is expected to grow at a steady rate, as more users in North America, Europe and South America activate accounts.

It is unlikely that a new competition will emerge in the North American market, as Tinder, Bumble and Hinge cover casual to serious; students to middle aged professionals. Other services like OKCupid and Match.com cover older and more serious relationships.

Even though China has become a key market for online dating, unless there is a social revolution that empowers casual dating over finding a partner, we expect the market to remain smaller than North America and Europe.

-